Register

Custom Duty on Courier From India to USA: Rules, Rates & Charges

Sending products from India to the USA has become very common these days. People in the USA usually buy electronics, clothes, gifts, beauty items, or festival products from Indian stores. But one thing that many buyers worry about is customs duty on courier from India to the USA.

If you don’t understand the rules, charges, and process, customs can feel confusing. In this guide, you will learn how customs duty works, what rates apply, what extra charges you may face, and how MyXBorder can simplify the entire process for you.

What is Customs Duty on Courier from India to USA?

Custom duty is a tax charged by Indian customs on goods imported from another country. When a courier arrives in the USA from India, customs officers check the package value, product type, and documents. Based on this, they calculate the duty and taxes. Custom duty on courier from India to the USA depends on:

-

The value of the product

-

The category of items

-

Shipping and insurance cost

-

Purpose of import (personal or commercial)

Even if someone sends you a gift, you may have to pay customs duty if the gift is expensive or crosses the allowed value limit.

Learn how to Ship Internationally From India with MyXBorder

Key rules for sending couriers from India to the USA

Indian customs has some basic rules for packages that come by courier. If your package value is low, you might pay less duty or sometimes no duty at all. But expensive items, branded products, electronics, and business orders usually have customs charges.

Some important things to remember are:

-

The price shown on the invoice must be correct

-

If you show the wrong price or details, your package can get stuck, or you may have to pay a fine

-

Certain products need extra permission before they are allowed into India

-

Even second-hand or used items are checked by customs

During festival season, a large number of parcels arrive, so customs becomes more strict. If the paperwork is not correct, delays are very likely.

Know more about how to Send a parcel from India to the USA

Understanding customs duty rates and extra charges

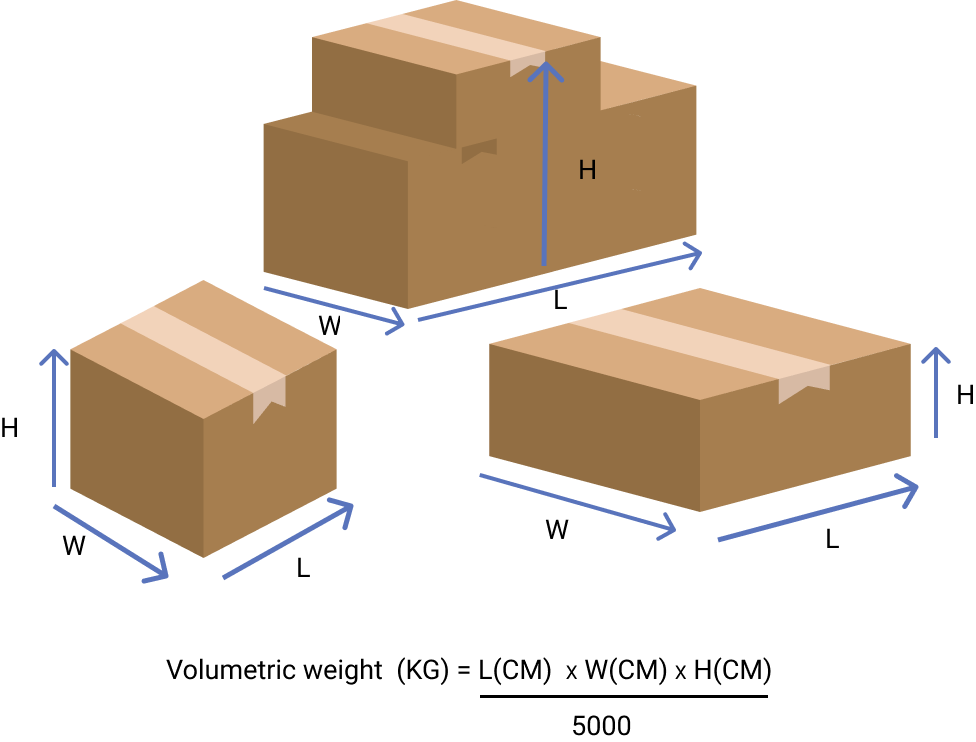

There is no one fixed customs duty for all items coming from India to the USA. When your courier reaches the USA, customs adds a few types of taxes together to calculate the final amount you have to pay. Customs duty on a courier from India to the USA usually includes:

-

Basic Customs Duty

-

IGST (Integrated GST)

-

Social Welfare Surcharge

Expensive items like mobiles, electronics, and luxury products usually have a higher duty. Apart from customs duty, there can be extra charges. These may include courier service fees, customs clearance charges, and sometimes storage charges. Because of all these steps and charges, having a professional shipping partner helps a lot.

Understand How to track parcels from India after shipping internationally

Final thoughts

When you understand the rules, rates, and charges, international shopping becomes much easier. With MyXBorder’s services you get full support from product sourcing to doorstep delivery in India Whether you are buying a single item or importing bulk, your parcels will reach you safely, on time, and without hidden surprises.

Offers from MyXBorder

Shipping Rates

Calculate your cost of shipping.

How MyXBorder simplifies your shipping experience

MyXBorder offers full international shipping support so you don’t have to deal with customs confusion. Their services are for all individuals, shoppers, and sellers who want stress-free worldwide shipping.

Shop-N-Ship Service - With the help of this service, you can buy products from Indian stores even if they don’t ship to the USA MyXBorder provides you with a local Indian address. Once the product reaches their warehouse, they handle packaging, paperwork, customs processing, and delivery to the USA. This reduces errors in customs duty calculation and avoids unnecessary delays

Assisted Shop-N-Ship - If you don’t want to deal with shopping yourself, Assisted Shop-N-Ship is the go-to option. MyXBorder helps you source the product from Indian sellers, place the order, receive it, check quality, and ships it to USA. This is very helpful during festive seasons when items go out of stock quickly.

Seller Assistance Service - This service is really helpful for sellers and importers because this includes supplier coordination, bulk imports, documentation, customs clearance, and last-mile delivery. If you are importing goods for resale, this service helps you stay cooperative with customs rules and manage costs better.

Stats

10000+

Orders

170+

Countries we serve

20000+

users